Airbus encourages Chinese Airlines to invest in larger aircraft amid post-pandemic travel boom.

As the post-pandemic travel boom sweeps across the globe, Airbus is pushing Chinese airlines to place orders for its largest aircraft, Bloomberg reports. The demand for slots, fueled by major purchases from other carriers and supply-chain issues, is rapidly intensifying.

The availability of slots is swiftly changing, pushing Airbus to expedite discussions with Chinese clientele, said George Xu, CEO of Airbus China, during an interview at the company's Tianjin production line.

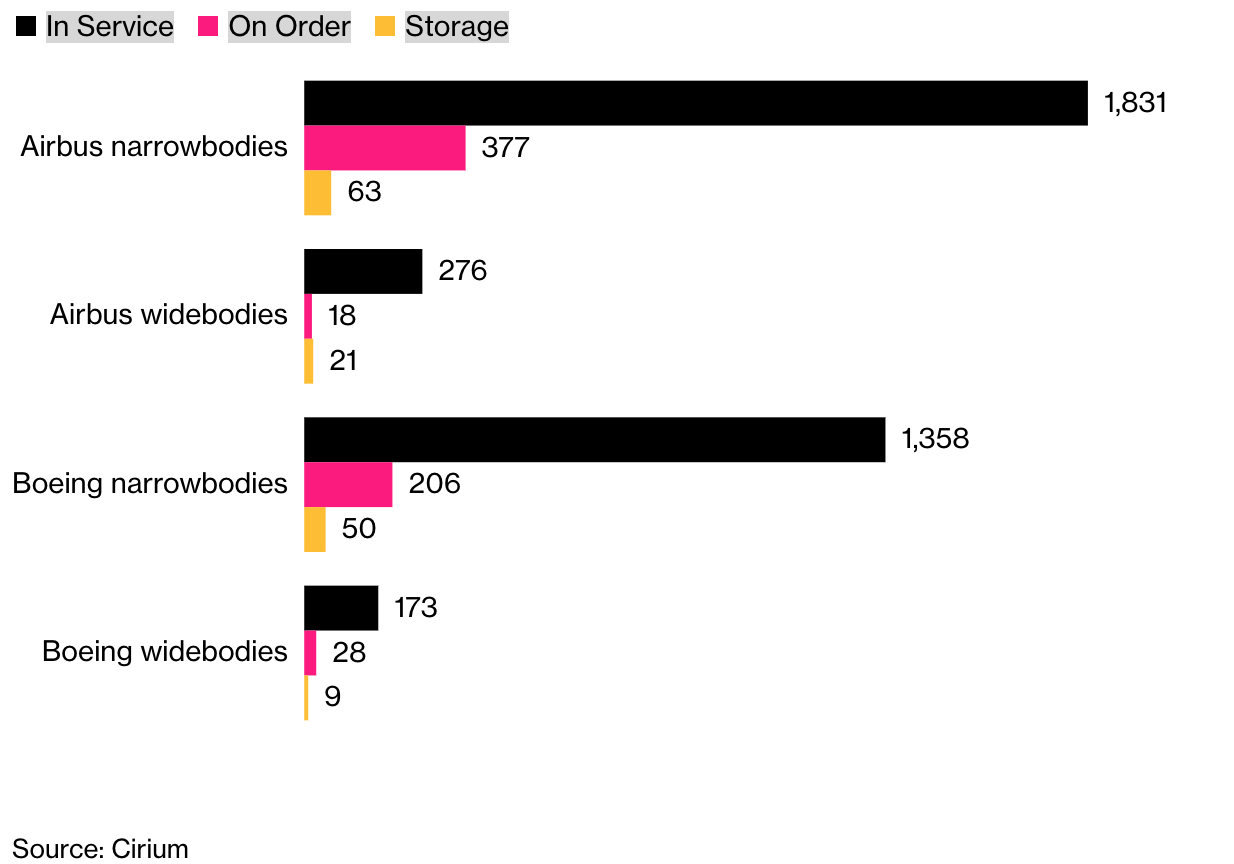

Last year, Chinese airlines invested in 332 single-aisle Airbus jets, approximately $42 billion at list prices. However, orders for wide-body aircraft have dwindled, with a backlog of less than two dozen larger twin-aisle planes, according to aviation data company Cirium. Meanwhile, Boeing's orders from China have dramatically shrunk due to the fallout from the 737 MAX crashes and political tension between China and the US.

How Airbus and Boeing Stack Up in China

Airbus is nearing the limit of its delivery slots for the A320neo family of narrowbodies, with availability stretching up until 2030. Boeing's 737 MAX slots are practically sold out until 2028.

Christian Scherer, Airbus Chief Commercial Officer, expressed concern last month that the waiting period for twin-aisle jets is also extending. Airbus predicts that between 2023 and 2042, Chinese airlines will require approximately 9,440 new aircraft, with widebodies making up about 15% of that figure.

"Asia represents half of the global demand for the next two decades, with China accounting for nearly half of Asia's demand," Xu informed Bloomberg Television.

Airbus aims to deliver 720 aircraft in 2023, upping the output—a target it fell short of in 2022. By May, the company had completed about one-third of its delivery objective, hinting at another push to meet the yearly deadline.

In China, travel demand is rebounding as the nation recovers from Covid-induced lockdowns and travel restrictions. Domestic air travel is bouncing back more robustly, but international services are also resurging.

Around 50 Chinese airlines operate approximately 3,190 single-aisle and 449 twin-aisle aircraft. The "Big Three" - Air China Ltd., China Southern Airlines Co., and China Eastern Airlines Corp. - comprise two-thirds of the total fleet, boasting planes with an average age of around 8 years.

Airbus constructs its largest jets at its Toulouse, France, headquarters. Single-aisle planes are also assembled in Hamburg, Germany; Mobile, Alabama; Montreal, Canada; and Tianjin, China, which is also a completion facility for larger A330 and A350 models.

A second A320 final-assembly line is set to be established in Tianjin, doubling the production capacity to 12 planes per month. This new line, set to start operations in 2025, is crucial for Airbus's goal of producing up to 75 jets globally per month by 2026.

Airbus also plans to hire an additional 400 employees in Tianjin to support the new line, raising the total staff count to 1,400, Xu added.

Considering the earliest slots for the A320 are available in 2029, Xu suggested that the A220, the company's smaller single-aisle jet, could be an excellent alternative for Chinese airlines looking to secure earlier slots.

Christian Scherer, Airbus Chief Commercial Officer, expressed concern last month that the waiting period for twin-aisle jets is also extending. Airbus predicts that between 2023 and 2042, Chinese airlines will require approximately 9,440 new aircraft, with widebodies making up about 15% of that figure.

"Asia represents half of the global demand for the next two decades, with China accounting for nearly half of Asia's demand," Xu informed Bloomberg Television.

Airbus aims to deliver 720 aircraft in 2023, upping the output—a target it fell short of in 2022. By May, the company had completed about one-third of its delivery objective, hinting at another push to meet the yearly deadline.

In China, travel demand is rebounding as the nation recovers from Covid-induced lockdowns and travel restrictions. Domestic air travel is bouncing back more robustly, but international services are also resurging.

Around 50 Chinese airlines operate approximately 3,190 single-aisle and 449 twin-aisle aircraft. The "Big Three" - Air China Ltd., China Southern Airlines Co., and China Eastern Airlines Corp. - comprise two-thirds of the total fleet, boasting planes with an average age of around 8 years.

Airbus constructs its largest jets at its Toulouse, France, headquarters. Single-aisle planes are also assembled in Hamburg, Germany; Mobile, Alabama; Montreal, Canada; and Tianjin, China, which is also a completion facility for larger A330 and A350 models.

A second A320 final-assembly line is set to be established in Tianjin, doubling the production capacity to 12 planes per month. This new line, set to start operations in 2025, is crucial for Airbus's goal of producing up to 75 jets globally per month by 2026.

Airbus also plans to hire an additional 400 employees in Tianjin to support the new line, raising the total staff count to 1,400, Xu added.

Considering the earliest slots for the A320 are available in 2029, Xu suggested that the A220, the company's smaller single-aisle jet, could be an excellent alternative for Chinese airlines looking to secure earlier slots.